Vehicle Prices Begin Downward Trend in the U.S., Despite Inflationary Pressure

In 2024, the automotive market is experiencing a notable shift towards affordability, with declining new and used vehicle prices, growing inventories, and strategic EV price reductions.

February 15, 2024

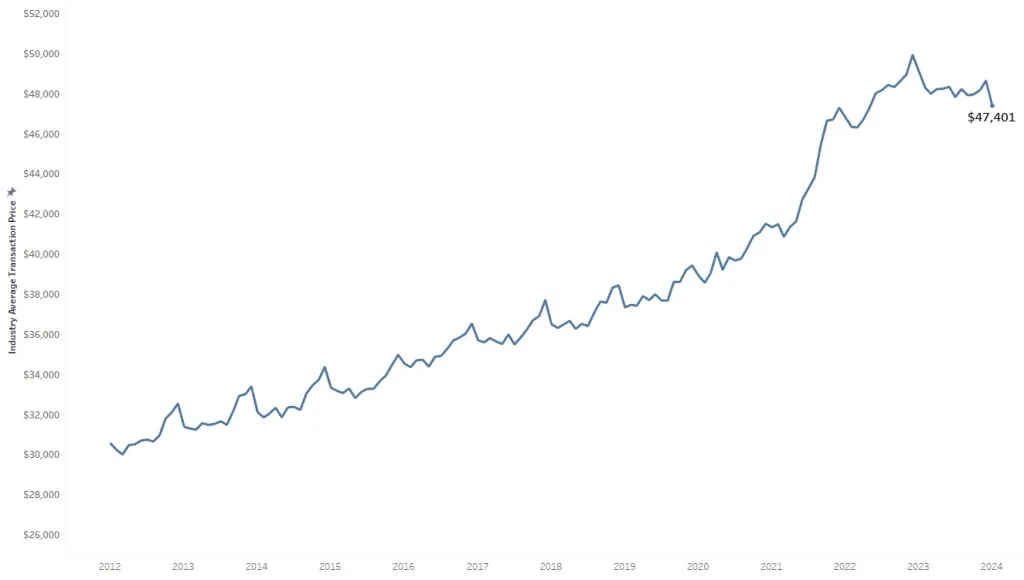

In a surprising shift amidst ongoing inflationary pressures, the automotive market has seen a notable decrease in new-vehicle transaction prices for the first time in years. According to the latest report from Kelley Blue Book, the average transaction price for new vehicles in the United States experienced a significant drop of 3.5% year over year in January. This decline marks a pivotal moment for consumers and the auto industry alike, as prices adjust downward in response to a variety of factors. Kelley Blue Book's detailed analysis reveals that the U.S. new-vehicle average transaction price (ATP) in January stood at $47,401, down from December 2023 by 2.6%, showcasing a remarkable trend of decreasing prices across the board.

The decline in vehicle transaction prices in January, while typical when compared to the higher figures often seen in December, stands out more significantly when observed on a year-over-year basis. Historically, January is known for lower sales and transaction prices due to a post-holiday season slowdown and the end of year-end sales incentives, making this month's prices generally lower than December's. However, the year-over-year decrease underscores a unique trend, diverging from the usual seasonal patterns. This shift can be attributed in part to increased discounts and incentives offered by dealers eager to maintain sales momentum in the face of rising inventory levels and a shifting market dynamic. Kelley Blue Book's report highlights that discounts and incentives in January averaged 5.7% of the average transaction price (ATP), up from 5.5% in December and nearly doubled compared to the same period last year, suggesting a strategic push to attract buyers despite the traditional January lull.

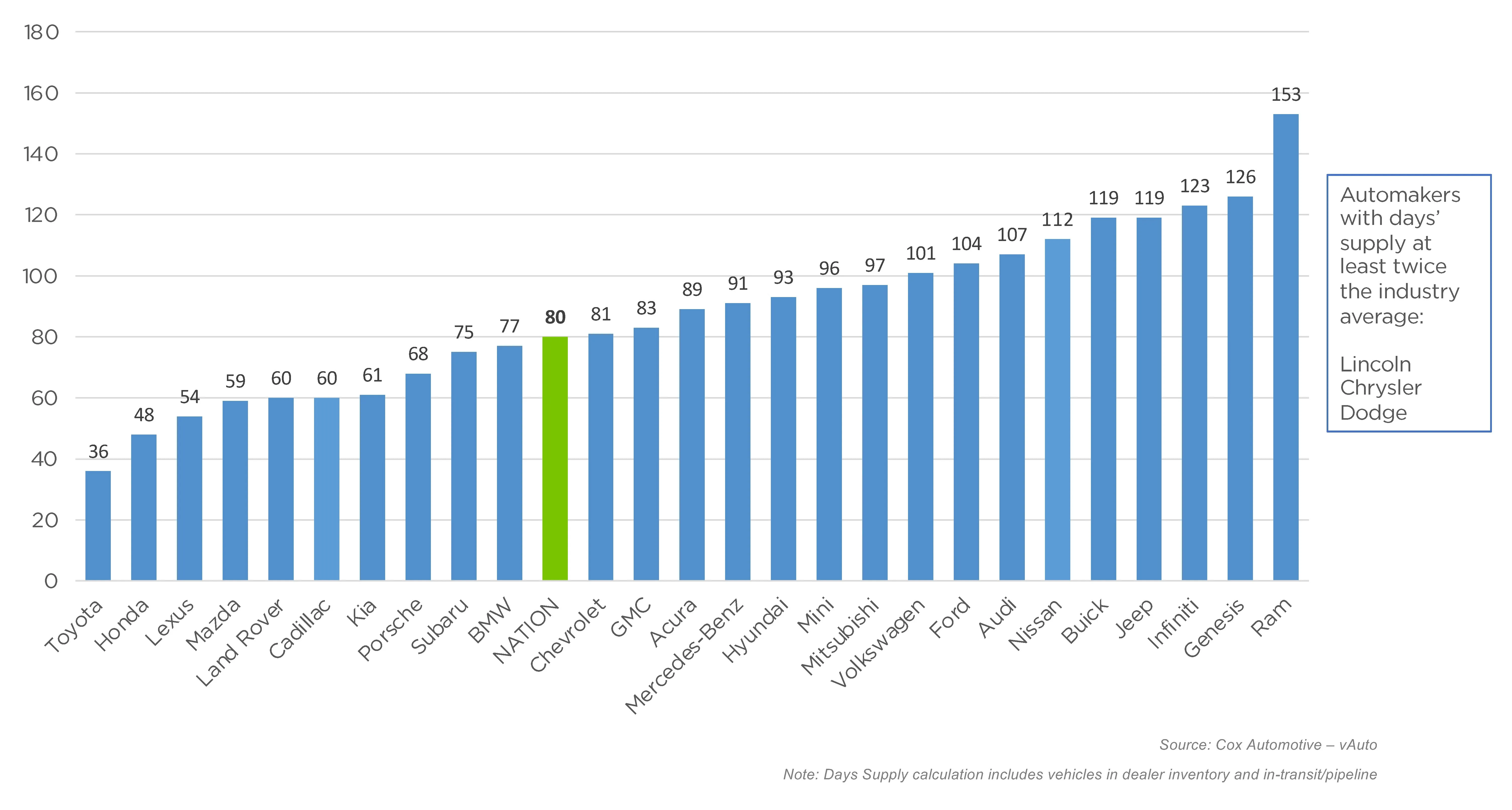

Building on the backdrop of adjusted pricing strategies, the inventory landscape further illuminates the current state of the automotive market. As dealers ramp up incentives to entice buyers, the national inventory levels have also seen a significant uptick in February, reaching an 80-day supply on average across the industry—a figure not seen since June 2020. This increase in available vehicles signals a shift from the tight inventory constraints experienced in previous years and especially during the pandemic, offering consumers a broader selection of models and options. Among the brands, domestic automakers such as Dodge, Chrysler, Lincoln, and Ram are leading with the highest inventory levels, showcasing a wide margin of availability. Conversely, Asian imports like Toyota, Honda, Lexus, and Mazda report the lowest supply, indicating a tighter market for these brands.

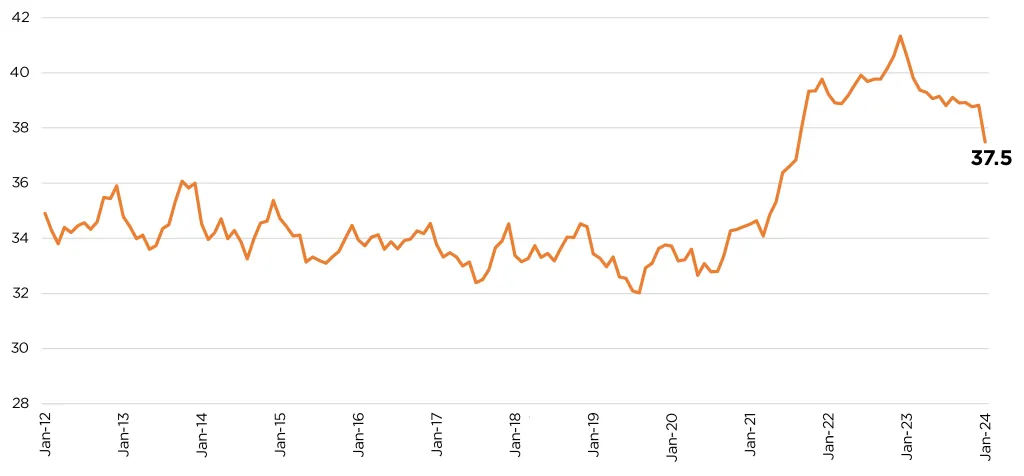

Amidst these market dynamics, the affordability of new vehicles has seen a notable improvement in 2024, marking a significant turn in the tide for consumers. According to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index, new-vehicle affordability reached its best level in over two years, driven by a combination of factors including income growth, declining average vehicle prices, and a slight reduction in interest rates. However, the landscape of auto credit has simultaneously tightened, presenting a mixed picture for potential buyers. Credit conditions have become more stringent, with access to auto credit dipping to its lowest level since August 2020, potentially offsetting some of the gains in affordability. Despite these tighter credit conditions, the payment metrics have shifted favorably for consumers. The typical new-vehicle loan payment declined by 3.2%, and the number of median weeks of income needed to purchase the average new vehicle decreased, making it easier for a wider swath of the population to consider purchasing a new vehicle. This complex interplay between credit accessibility and payment affordability underscores the evolving nature of the automotive market in 2024, where improved purchase conditions face the headwinds of stricter lending standards.

Despite accounting for around 10% of the overall new car market in the United States in 2023, the electric vehicle (EV) segment may have contributed to shaping automotive affordability and market dynamics. Price reductions by industry giants like Tesla, along with emerging brands such as Rivian and Lucid, have significantly lowered EV prices in the past couple of months, making them more accessible and exerting downward pressure on the broader automotive market's pricing strategies. These strategic adjustments have compelled traditional automakers to adapt their pricing in response to maintain competitiveness.

Mirroring the trends observed in the new car market, the used car sector is also experiencing a notable decline in prices, reinforcing the broader movement towards greater automotive affordability. According to insights from CarFinderZone, the used car market, particularly within the Fleet Car Market segment as an example, has seen a significant adjustment in its pricing dynamics. CarFinderZone Market Trends report a 5.2% drop in the average sales price of used fleet cars for sale from February 2023 to February 2024. Concurrently, the inventory of cars available for sale in this segment has increased by 6.3% year-over-year, indicating a shift towards a buyer's market. This trend of falling prices coupled with rising inventories suggests that consumers looking for pre-owned vehicles are now in a better position to find more options at lower prices, echoing the broader affordability trends affecting the automotive industry as a whole.

As we look at the broader trends shaping the automotive market in 2024, it's becoming increasingly clear that this may be the year when vehicle affordability aligns more closely with long-term norms. The combination of declining new and used vehicle prices, increased inventory levels, and strategic adjustments in the EV sector points towards a market that is gradually shifting in favor of the consumer. With these trends expected to continue, consumers may find themselves in a stronger position to negotiate better deals as the year progresses. Whether it's the allure of the latest electric models, the practicality of a new vehicle, or the value found in the used car market, the dynamics of 2024 are poised to offer more accessible options for buyers across the board. This shift towards affordability could mark a significant turning point, providing a much-needed reprieve for consumers in an industry that has been characterized by high prices and tight supply in recent years.